The Blockchain Ecosystem In Sāo Paulo: It’s Maravilhosa

Brazil is full of contradictions and opportunity. It is the eighth largest economy in the world and ranked third for having the most entrepreneurs. I got a glimpse of Brazil’s innovative entrepreneurial culture when I visited MAR ventures, a Sāo Paulo-based venture builder, and then again when I met with attorneys in Sāo Paulo. However, Brazil is also ranked as one of the hardest countries in which to do business due to regulations and complicated bureaucracy — which I also saw first hand.

Alexandre Liuzzi is the founder and CEO of MAR ventures and Alexandre Garcia is his partner and Head of Blockchain. Most of the businesses that are built at MAR ventures use emerging technologies, such as blockchain, to create products and services for Brazil’s financial sector. Alex L. and Alex G. — one a finance professional and the other an attorney — together with their colleagues and business partners help the new ventures go from ideas to thriving businesses.

Their goal is to expand Sāo Paulo’s blockchain community by creating blockchain-enabled financial products. They want to be the bridge between the coders and bitcoiners, and the traditional institutions in finance, law and government, to create a financial markets infrastructure network that will serve all members of society. A laudable goal.

I had been talking with Alex L. and Alex G. for more than a year when they invited me to Sāo Paulo to give a talk about my experience leading the Delaware Blockchain Initiative (DBI). They offered to make all of the arrangements (including covering my airfare and logistics) and I accepted their invitation. During my two-day whirlwind visit, I had a great opportunity to meet with entrepreneurs, as well as technology, finance, legal and other professionals.

Alexandre Liuzzi, Alexandre Garcia and me

My impressions are twofold. First, I was immensely impressed with the Alex L.’s and Alex G.’s vision to foster an entrepreneurial ecosystem in Sāo Paulo for the public good, and the entrepreneurial pursuits that they and their colleagues are leading, which I discuss below. Second, I was surprised to learn about the complex corporate record-keeping requirements that crept into nearly every conversation I had with Brazilian attorneys during my visit.

The blockchain entrepreneurs at MAR ventures are innovating across many areas including education, credit and payment systems. On the education front, Mosaico University is developing blockchain content and forming alliances with universities in Brazil, South America, and the United States. The content covers blockchain fundamentals and real applications, including how to create new businesses leveraged by the technology. They have also developed an 8-hour course to teach blockchain concepts to attorneys, judges and law enthusiasts. The course is presented by Alex G. and Hamilton Amorim, also know as “O Algorista”, a Brazilian cypherpunk who, together with MAR ventures, is creating a blockchain protocol, called Tachyon.

BeeTech, led by Fernando Pavani, delivers cross border payments to and from Brazil and is the first independent platform to use the Ripple infrastructure. They have reduced the time it takes to make cross border payments (including the corresponding registrations before the Brazilian Central Bank) from, between 48-72 hours, to just one hour, and with lower costs than other financial institutions. But this is just the beginning. They hope to provide for a cross-border payment infrastructure to allow businesses and individuals to become global, directly connecting their digital wallets to global financial services.

On the credit side, F(x) — function of x – provides financial institutions and businesses a digital platform so that small and medium sized companies can connect with more than 200 financial institutions, streamlining the process and reducing the cost and time to obtain a loan. Led by Dan Cohen, the venture aims to use the Tachyon protocol coupled with artificial intelligence to digitize assets (including receivables certificates, ERP licenses, machinery, etc.) to transfer and secure collateral for the credit transactions carried on the F(x) platform. This is significant because in Brazil, many small and medium sized companies are unable to get credit and, those that do, usually have to wait up to 90 days or more to clear the loan and still suffer the highest spreads in the world. With the F(x) platform, participants will obtain finance with less cost and bureaucracy, and considerably shorter wait times (that are measured in mere days, as opposed to months).

The first use case from Alex L. and Alex G. deploying the Tachyon protocol is a Brazilian instant-payment infrastructure that will enable individuals and organizations to transfer value efficiently and cost effectively using a combination of on-chain and off chain functionality. Their platform will be geared toward small and medium size businesses that traditionally have been underserved by Brazil’s financial institutions, and will allow them to make payments instantly. They plan to combine their solution with BeeTech’s cross border application and the F(x) algorithm, along with its access to credit investors, to create a real time global infrastructure for trade finance. This innovative solution could become the rocket fuel that spurs economic growth in Sao Paulo and beyond.

The introduction that led to my trip and to MAR ventures was provided by Rosine Kadamani, a trailblazer in the blockchain ecosystem in Sāo Paulo. In 2016, she founded, Blockchain Academy, the leading school in Brazil for blockchain content and coding, which she leads today. Her courses are taught throughout Brazil, South America and beyond. With more than 30 courses and thousands of graduates from all areas, Blockchain Academy has become an important resource and catalyst in Sāo Paulo’s blockchain community. I met Rosine four years ago on a trade mission for the State of Delaware. At the time, Rosine was a top corporate attorney at one of Brazil’s best law firms.

Moving on now to my conversations with Brazil’s top corporate attorneys.

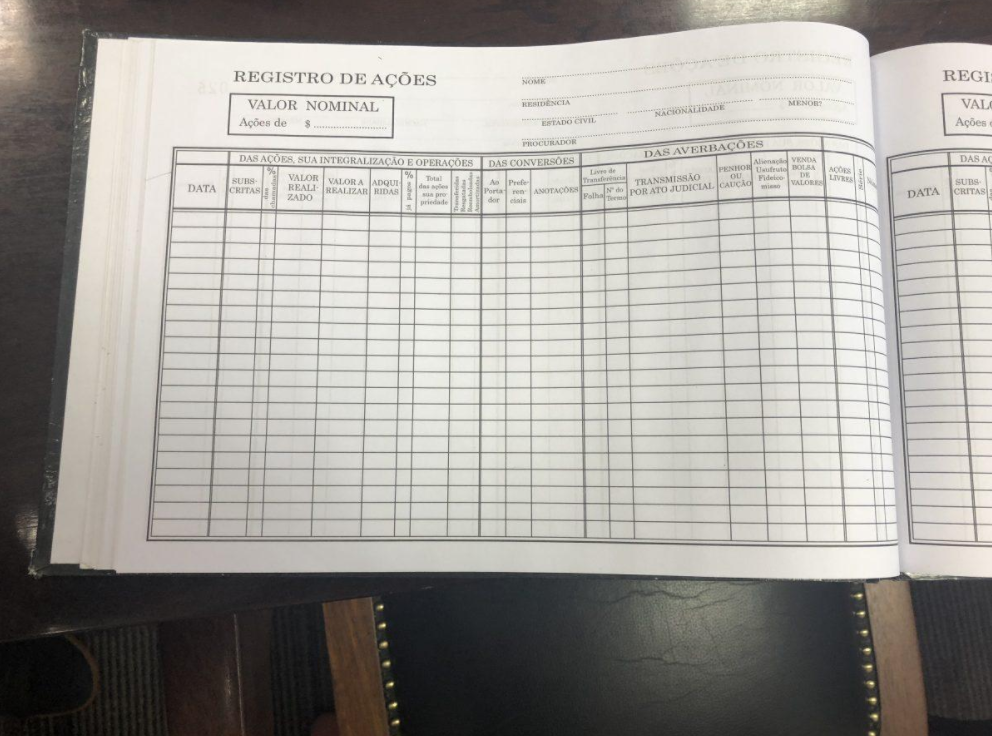

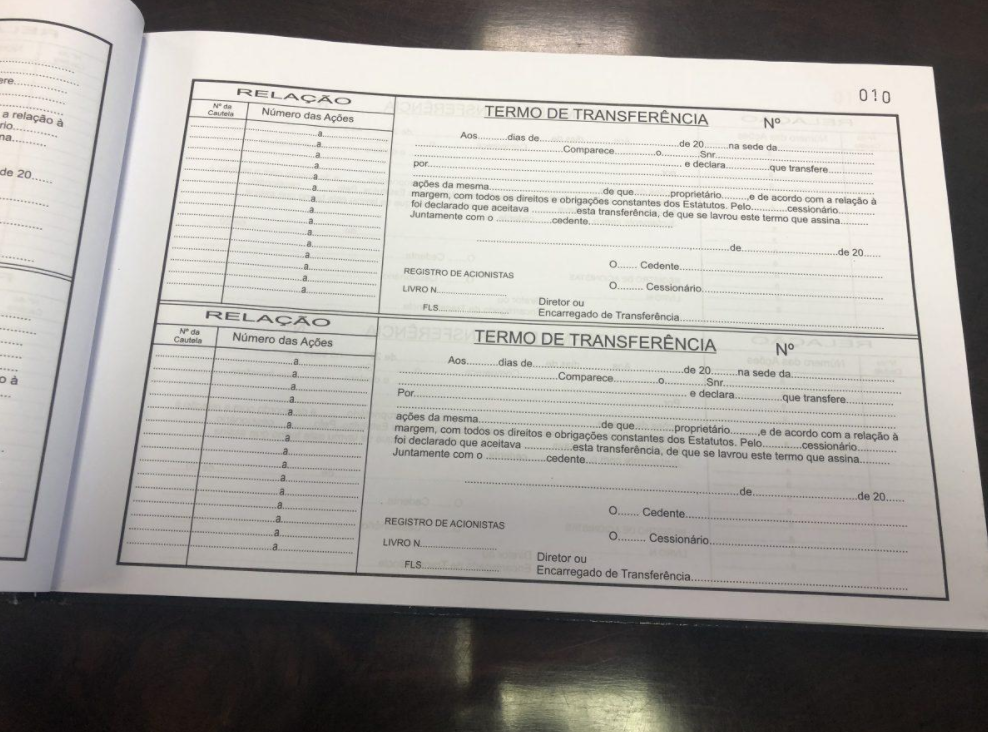

I had been invited to talk with several attorneys in Sāo Paulo about Delaware’s Blockchain Amendments. Enacted in July 2017, the Delaware Blockchain Amendments allow corporations to issue shares and maintain their corporate records on a blockchain. These rules stand in deep contrast to the rules of Commercial Registry — a Sāo Paulo government agency — which require corporations to maintain two (paper) books for the recordation of share ownership, one that lists the shareholders, and the other that tracks all transfers. All transfers must be authorized by both transferor and the transferee by signing the books. Every page must be filled out perfectly. Any mistake will invalidate the entire page.

Book of Shareholders (where the list of shareholders is maintained)

Generally, lawyers or paralegals are in charge of keeping the books on behalf of the corporations. Shares are issued by inserting the shareholders’ names in the Book of Shareholders. Before a company can be sold, both books must be reconciled to get a complete and accurate accounting of who owns how many shares. Any mistake on the books may lead to stronger representations and/or holdbacks in a M&A deal.

Transfer Ledger

During our conversations, the attorneys expressed deep appreciation for Delaware’s new blockchain laws. They explained that their current system of keeping track of share ownership is not only cumbersome, but actually inhibits capital formation due to the great difficulty of capturing and maintaining investor information compliantly. I explained that in Delaware, we changed the Delaware General Corporate Law to alleviate the burden of maintaining cap tables on a digital spreadsheet, like Excel. And they said, “if only.” Perhaps we will soon see changes to the Commercial Registry rules so that companies in Sāo Paulo can maintain their stock ledgers electronically or on a blockchain.